Were you denied business credit or a mortgage loan due to a low credit score?

Unfortunately, it could take you many years to build a high credit score. BUT why risk losing time? There is a WAY to immediately mirror someone else’s excellent credit history. It’s called Piggybacking Tradelines.

Through piggybacking tradelines, you pay a fee to be an authorized user on a borrower's tradeline. A 'tradeline' is the activity reported to credit bureaus on the credit extended to a borrower. Becoming an authorized user, all activity since the borrower was approved for credit will reflect on your credit records. This in turn creates a positive impact on credit

scoring algorithms, which QUICKLY improves your credit rating.

Applying piggybacking tradelines, YOU CAN:

Boost your credit score up to 200 points

Improve your credit rating in 7 to 14 days

Get approved for business credit lines

A 'tradeline' is the activity reported to credit bureaus on the credit extended to a borrower. When you become an authorized user on a borrower's tradeline, all the activity since the borrower was approved for credit immediately reflects on your credit records. In turn, the new positive credit information can rapidly increase your credit score.

FACT: One or more seasoned tradelines can boost your FICO score by 35 to 200 points.

One in three Americans is an authorized user on someone else’s account. This privilege, which is promoted by banks, allows authorized users to make purchases without being responsible for making payments. However, tradeline brokers restrict authorized users from making purchases in order to maximize the effectiveness of an added tradeline.

Piggybacking tradelines is permitted by The Federal Trade Commission, which states: 'piggybacking credit' or "adding another person to a primary cardholder's credit card account as an authorized user is legal."

Piggybacking tradelines is recognized by a Federal Reserve publication, which states: "By adding tradelines for credit, the authorized user may be able to increase their credit in advance of a credit application, and possibly cause lower borrowing costs or a capability to qualify for credit that otherwise would not be offered.”

Piggybacking tradelines is protected by Regulation B of the Equal Credit Opportunity Act (ECOA) of 1974, which states: "It is unlawful for any lending institution to ignore credit history present in a credit report, regardless of authorized user status, or otherwise.”

Piggybacking tradelines (the practice of adding authorized users) is also encouraged by creditors.

HERE’S PROOF:

(Chase Slate Visa card email advertisement):

FACT: One in three Americans is an authorized user on someone else’s credit card account.

You get added as an authorized user to the seasoned trade line of a borrower with an excellent credit rating.

Within 30 days or less, the full trade line history is also reported on your credit records.

The trade line reporting positively impacts credit scoring algorithms, which improves your credit score and credit approval odds.

Also known as 'aged tradelines’, seasoned tradelines can considerably improve your FICO® score and odds of getting approved for business credit lines.

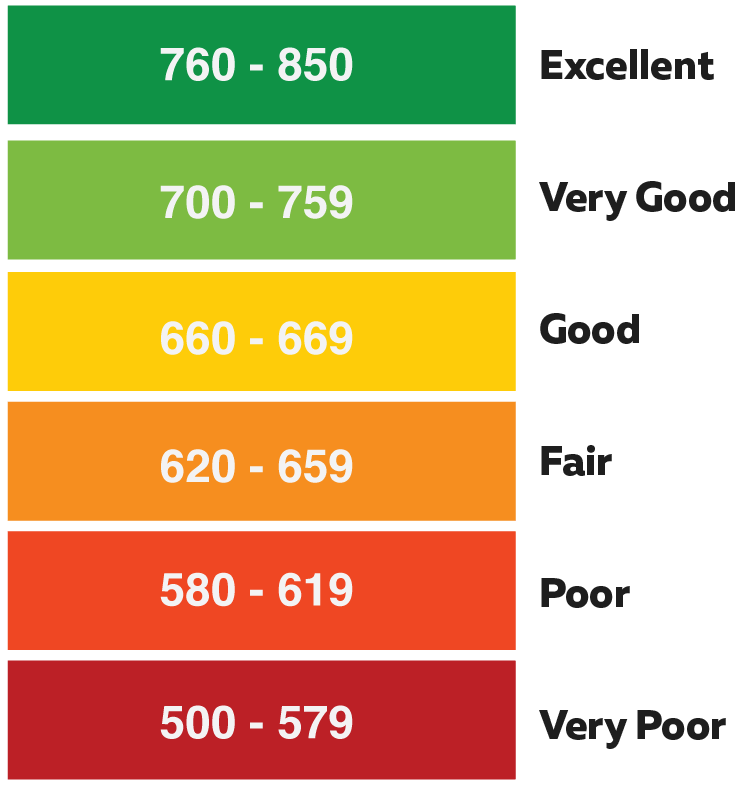

Having a strong FICO® score is very important. From over a dozen credit scoring models, the FICO® score is used in 90% all credit decisions. If your FICO® score is below 580, it labels you a 'very poor' credit risk and warns lenders that you are likely to default on future loan obligations. To improve your borrowing power and chances of qualifying for business credit lines, your FICO® score should be between 680 (good) and 850 (excellent). A quick way to reach this range by is purchasing one or more seasoned tradelines. The word ‘seasoned' refers to a tradeline that has a longer credit history, typically five years or greater.

As illustrated below, a seasoned tradeline can positively impact four out of the five FICO® scoring components:

1) Payment History

The amounts owed or 'credit utilization' on revolving accounts, such as credit cards, makes up 30% of the FICO score and represents up to 165 points.

You generally need to have a minimum history of borrowing and repaying loans of five years. Lenders will turn you down for business credit if you have little or no payment history because you are not providing them enough information to evaluate your credit risk.

2) Amounts Owed (Credit Utilization)

The amounts owed or 'credit utilization' on revolving accounts, such as credit cards, makes up 30% of the FICO® score and represents up to 165 points.

High credit utilization indicates you have difficulty managing your finances. However, lenders want to see a credit utilization below 30% of the credit limit. If your spending is over this rate, you have a high credit utilization, which indicates poor credit management skills and overspending. However, adding seasoned tradelines to your credit mix, you can lower your utilization by increasing your total credit limit.

3) Length of credit history

The length of credit history makes up 15% of the FICO® score and represents up to 82.5 points. Seasoned tradelines normally have a minimum length of credit history of five years.

4) Credit mix

The mix of accounts makes up 10% of the FICO® score and represents up to 55 points. A good credit mix consists of 3 credit cards, 1 mortgage loan and 1 installment loan.

In order to get positive results from an authorized user tradeline, you should have little or no negative credit items on your credit file. Excessive derogatory accounts can offset the intended benefits. Before deciding to purchase an authorized user tradeline, we also recommend seeking the advice of a business credit consultant. Improperly selecting a tradeline that has a short credit history or high credit utilization can actually lower your credit score and hurt your credit rating.

Our aim is to get you the funding your business needs. i5CREDIT business credit consultants have extensive experience working with a variety of lenders and underwriting requirements. Please call us today for a complimentary review of your 3 bureau credit report. We will detect deficiencies on your credit report and recommend the best solution to quickly improve your credit rating and borrowing power.